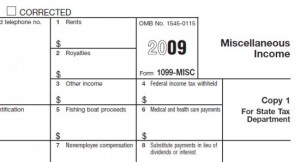

A provision tucked into President Obama’s Patient Protection and Affordable Care Act ironically mandates more IRS reporting for all businesses here in Wilmington NC, starting in January of 2013, for the 2012 tax year.

UPDATE: 4/15/2011

After much national grumbling about the additional Form1099-MISC reporting requirements, President Obama signed its repeal today. A rare example of curbing IRS power. But the additional penalties remain intact.

Example

In January 2011 the (fictional) CPA for Wilmington NC Widgets, our demo S Corporation, filed 10 IRS Form 1099 Misc: 9 to subcontractors it paid more than $600 to during 2010 and the 10th to Wilmington NC Widgets’ landlord in Castle Hayne for rent. In 2013, the CPA is likely to file over 200 Form 1099 Misc(s) for WNW:

- The same 9 to NC subcontractors.

- The same one to the Castle Hayne landlord.

- And an additional 190 Form 1099s to WNW vendors.

Currently

For 2011, Wilmington NC Widgets’ status as a S Corporation means it’s CPA doesn’t have to 1099 corporate vendors, even if it paid them over $600 during the calender year. So, theoretically, WNW could under report it’s revenue on Form 1120S, by, say, $40,000. Which also avoids personal income taxes to it’s share holders, by, say, $12,000. The IRS would have to use benchmarking and other statistical methods to detect this under reporting, which is difficult, especially if it occurs consistently year after year.

Revenue Matching

The IRS always has a tax gap defined as: what it calculates the total reported revenue in America should be for the tax year, less what actually is reported in the tax year. This is not revenue your CPA has legitimately whittled down through deductions and credits, the tax gap is revenue that is never reported. Like the 40G in the Wilmington NC Widget example. Billions supposedly. Revenue matching is a technique the IRS has found to be cost effective in closing the tax gap. An example: the IRS mandated W2 the CPA sends to Wilmington NC Widget employees every January. Remember the CPA also sends a copy of the W2 to the Social Security Administration on March 15th which finds its way into the IRS databases. The IRS then matches this info to the taxpayer’s Form 1040 and finds folks who didn’t report these wages as income. Naughty, naughty. Note that while revenue matching is cost effective for the IRS, it is a huge financial strain on employers forced to comply with payroll administration.

The new Form 1099 reporting requirements would help close that 40G revenue gap in Wilmington NC Widgets because the IRS will get more info from WNW customers. The 1099s will never total the actual WNW revenue because some of the customers paid them less than $600 during the year, and didn’t have to report it to the IRS. Cash payments don’t factor in either. Revenue matching means Wilmington NC Widgets might only be able to under report by 10G instead of 40G in 2012. Which might mean, say, $9,000 more in tax collected. Additional cost to WNW customers for the expanded reporting? Maybe $400 in software patches, forms, wages, postage and CPA fees.

Complications

In 2011 the IRS rolls out Form 1099K, on which credit/debit card clearing houses report payments, made to businesses, over $600 per year.

Penalties

$50 for unitentional 1099 omission and $100 for every intentional omission. Watch out, these could add up quick!

Please consider calling us if you need a free initial consult with a Wilmington NC CPA. (910) 399-2705.

CPA Wilmington NC services include back tax cases and IRS resolution representation. We also offer tax expertise with a proactive attitude.

I have been just examining your site it is very well crafted, I am searching on the web looking for exactly how to do this blog site thing and your website definitely is quite impressive.

Good post and this mail helped me alot in my college assignement. Thank you for your information.

Excellent job.